(UPDATED) AMENDMENTS TO BURSA MALAYSIA SECURITIES BERHAD MAIN MARKET LISTING REQUIREMENTS IN RELATION TO SUSTAINABILITY REPORTING REQUIREMENTS AND OTHER ENHANCEMENTS

- AscendServ

- Aug 22, 2025

- 3 min read

Announced on 23 December 2024

Last updated on 22nd August 2025

Purpose:

in line with ongoing developments in the capital market landscape; to improve quality of disclosures in the marketplace; and safeguard shareholders' rights

National Sustainability Reporting Framework (NSRF)

Launch and Committee

The NSRF was launched on 24 September 2024 by the Advisory Committee of Sustainability Reporting ("ACSR"), an inter- agency committee which comprise representatives from Securities Commission Malaysia, Audit Oversight Board of the Securities Commission Malaysia, Bank Negara Malaysia, Companies Commission of Malaysia, Bursa Malaysia, and the Financial Reporting Foundation.

Access to Details

Details of the NSRF is accessible at https://www.sc.com.my/nsrf

Focus Areas of Amendments

Sustainability Reporting Requirements

Aligning the sustainability reporting framework with the National Sustainability Reporting Framework ("NSRF")

General Meeting Requirements

Promoting shareholder participation in general meetings of listed issuers by requiring physical or hybrid meetings

Related Adviser Requirements

Strengthening accountability of Recognised Principal Advisers which promoted applicants for listing by naming them in public documents of listed issuers for a specified period

PACE Initiative

PACE (Policy, Assumptions, Calculators and Education) is an initiative established by the Advisory Committee of Sustainability Reporting to support listed issuers in using the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures. PACE offers a wide range of resources to ensure companies of all sizes can meet the sustainability reporting requirements.

Policy: Guidance on sustainability policies

Calculators: Emissions calculators for companies

Education: Capacity building programmes

Resources: Wide range of support materials

The resources and guidance materials can be found on PACE's website at: https://www.sc.com.my/nsrf/pace.

Sustainability Reporting Requirements

Sustainability Statement Preparation

Requiring a sustainability statement in annual report ("Sustainability Statement") to be prepared in accordance with the IFRS Sustainability Disclosure Standards, specifically IFRS S1 and IFRS S2, and consequential to this, replacing the term <economic, environmental and social risks and opportunities= with <sustainability-related risks and opportunities (<SROs=)

Quantitative Information

Maintaining or modifying the existing disclosure of metrics and targets demonstrating performance and progress in relation to SROs for the last 3 financial years, and a summary of the data in a prescribed format

Statement of Assurance

A statement on whether the listed issuer has subjected the Sustainability Statement to internal review by its internal auditor or independent assurance performed in accordance with recognised assurance standards

Implementation Timeline

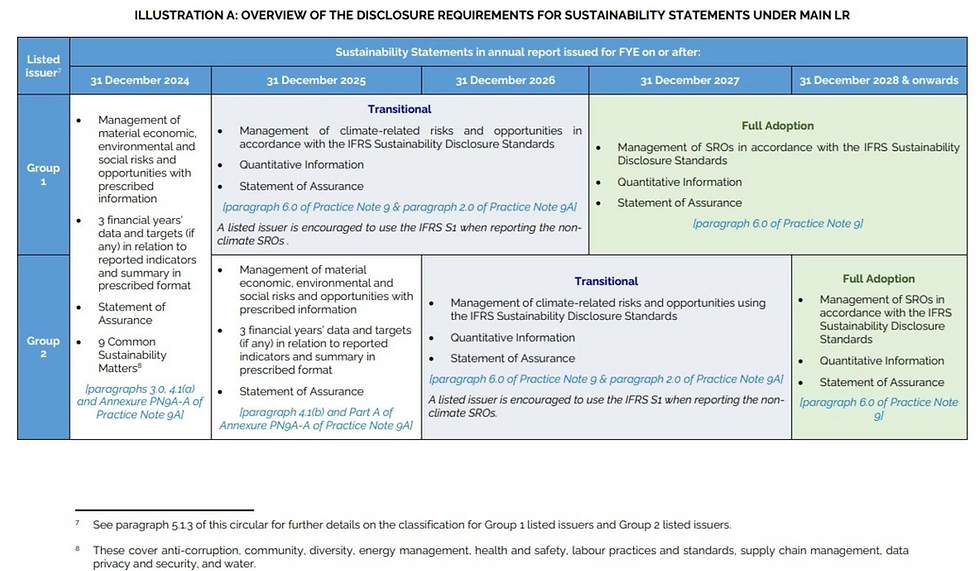

Group 1 Listed Issuers

Listed issuers with market capitalisation of RM2 billion and above as at 31 December 2024 or the date of admission to the Official List after 31 December 2024: Effective for FYE on or after 31 December 2025.

Group 2 Listed Issuers

All other listed issuers: Effective for FYE on or after 31 December 2026.

Transitional Period

For 2 full financial years commencing from the respective Effective Dates, listed issuers may adopt transition reliefs when preparing and issuing the Sustainability Statements.

General Meeting Requirements

Physical Venue Requirements

Requiring a listed issuer to hold its general meeting at a physical venue in Malaysia ("Main Venue")

Hybrid Meeting Compliance

If holding concurrent physical meetings or using virtual technology: - Put in place necessary tools and infrastructure for smooth broadcast and interactive participation - Ensure all shareholders have similar rights to speak and vote

Effective Date

Applicable to general meetings held on or after 1 March 2025

Shareholder Engagement

Listed issuers should aim to promote wider shareholder engagement and encourage participation at meetings

Related Adviser Requirements

Disclosure Requirement

Requiring a listed issuer to state the name of the Recognised Principal Adviser responsible for its admission to the Main Market in all its announcements and documents issued to its securities holders, for 2 full financial years from admission

Display Guidelines

The statement must be prominently displayed but does not imply that the named Recognised Principal Adviser is responsible for the matter stated in the announcements and documents, unless it is the adviser for such matter

Effective Date

Applicable to a listed issuer which is admitted to the Main Market on or after 2 January 2025

Prominently displayed: must be in print no smaller than the main text and displayed prominently on the front page of the announcement and documents

Comments